By The Arizona Bankers Association

An unpredictable economic climate calls for increased balance sheet flexibility. Financial institutions are currently facing challenges in managing liquidity, improving digital channels, and adapting services to survive and thrive in a rapidly changing environment. When planning ahead, financial institutions should consider alternative investment and loan portfolio diversification strategies, as well as new point-of-sale product solutions to supplement and enhance revenue.

Value Proposition

- High yield, short duration asset, par pricing on personal loans

- Ability to deploy liquidity quickly, no minimums or commitment schedules, place orders month-over-month

- No black box, bank partners can overlay credit criteria

- Ability to geo-target and purchase in the desired footprint

- Ability to cross-sell to upgrade borrowers

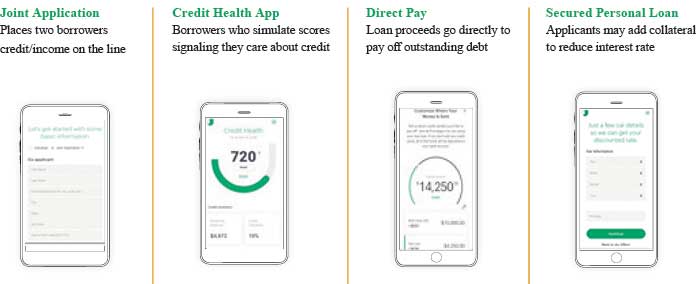

Borrower Technology Features That Enhance Credit Performance

The mainstream U.S. consumer is seeking a frictionless, easy to use, fast, digital experience when creating new customer product features. Features that enhance customer experience and improve their satisfaction while enhancing performance are ideal. This allows financial institutions to “positively select” themselves with users that have self-selected with a positive credit feature. The data has shown that consumers with one of the below features perform better than those without.

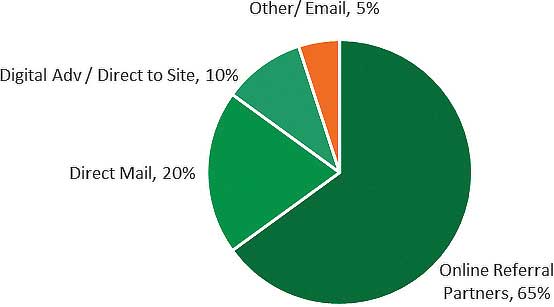

Digital Customer Acquisition

- Online Referral Partners: Partner channels significantly remove friction and economical cost of acquisition

- Direct Mail: Decreasing the percentage of originations in this channel due to highest cost of acquisition and high market saturation

- Credit Health / Email: Lowest cost of acquisition, performance predictability

- Digital / Direct to Site: SEO and direct mail “halo effect”

The Arizona Bankers Association

This story appears in Issue 4 2020 of The Arizona Banker Magazine.