Now, more than ever, your customers need a banker watching out for them.

Growth opportunities abound for community banks that proactively help customers relieve financial stress.

The fact that consumers are under significant pressure today comes as no surprise. Two years into a global pandemic, it is surprising that it’s not health, family or job issues that present the most prominent cause of stress — it’s household finances.

Even more unexpectedly, higher income doesn’t necessarily equate to less stress.

Below are some of the many highlights of the consumer research Jay Financial presented to the Arizona and Colorado Bankers Conference in November, based on recent surveys of Arizona and Colorado banking decision-makers belonging to the Generation Z, Millennial and Generation X age groups.

Where there’s need, there’s opportunity

Triggering consumers’ financial stress is a diverse array of immediate and longer-term concerns that people are eager to resolve. These uncertainties become priorities, driving interest in specific financial services and solutions.

Consumer interest in solutions is immediate

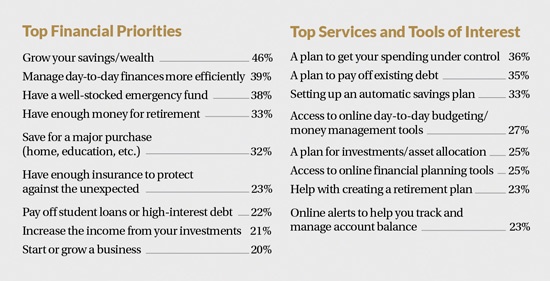

The Gen Z, Millennial and Gen X customers walking into your branches or engaging your digital channels — right now — have on average 3.3 financial priorities they want to address and 2.4 financial services or tools they are interested in obtaining.

Table: Percent of survey respondents selecting each of the following as their top financial priorities and top financial services and tools of interest

Community banks have a unique competitive advantage

The more complex or important the need, the more Arizona and Colorado consumers want to address these issues face-to-face with a banker. Between 62% and 77% of respondents prefer personal interaction when opening accounts, resolving account issues, learning about online/mobile/digital banking features, and getting advice about financial planning, retirement planning or household budgeting.

This continued interest in personal contact is a specific reason consumers continue to value branch visits.

- 83% of survey respondents agreed that branches are an important part of the banking experience

- 61% are visiting branches the same as or more than before than pandemic

- 68% visited a branch at least once in the previous 30 days

For those who prefer face-to-face contact, community banks are preferred over regional or national banking competitors, representing a significant competitive advantage. Undoubtedly digital banking strategy is critical to any bank’s ongoing success, but the survey data raises an equally critical question for community bankers:

What is your face-to-face banking strategy?

Looking out for your customers:

Previous Jay Financial research points to the importance of being known as a bank that looks out for its customers. This research, as well as our direct experience managing bank marketing communications campaigns, demonstrates that customers who perceive their bank is looking out for them are more loyal and more likely to open additional accounts than customers who feel otherwise. This takes customer advocacy — doing what’s best for your customers, even though it might not be best for the bank — one step further, in that the bank proactively finds ways to be the customer’s advocate.

Often, consumers feel they don’t have time to address their financial priorities, don’t know how to express what they need, or don’t know where to begin.

A proactive bank gets the conversation started for them.

This typically happens through your people at the branch level, although they will be more successful if supported by effective, needs-based merchandising, sales literature, and online resources. Ultimately, a data-driven sales and marketing communications plan is called for to deepen relationships with your customers by helping improve their financial management and financial security. In our experience, it can strengthen your brand, sell more products, and create happier, more loyal customers.

Lisa Kreienberg

Creative Director, Jay Financial

With over a quarter-century of developing successful marketing campaigns, Lisa truly appreciates how effective creative demands provide meaningful strategic insight.

Jeff Hughes

Director of Insights, Jay Financial

With over 40 years of experience in data-driven marketing for financial institutions, Jeff excels in helping clients better understand the customer and market dynamics to drive incremental growth.